The Greatest Guide To Feie Calculator

Table of ContentsThe Facts About Feie Calculator UncoveredFascination About Feie CalculatorThe Only Guide to Feie CalculatorGetting My Feie Calculator To WorkThe Definitive Guide to Feie Calculator

First, he marketed his united state home to develop his intent to live abroad permanently and made an application for a Mexican residency visa with his better half to help accomplish the Authentic Residency Test. Furthermore, Neil safeguarded a lasting building lease in Mexico, with strategies to eventually buy a home. "I presently have a six-month lease on a home in Mexico that I can prolong another six months, with the purpose to acquire a home down there." Neil points out that acquiring building abroad can be testing without very first experiencing the location."It's something that people require to be truly attentive about," he states, and advises expats to be mindful of usual blunders, such as overstaying in the U.S.

Neil is careful to stress to Tension tax united state tax obligation "I'm not conducting any carrying out any type of Illinois. The U.S. is one of the few countries that taxes its people no matter of where they live, suggesting that even if a deportee has no earnings from United state

tax return. "The Foreign Tax obligation Credit rating allows individuals functioning in high-tax nations like the UK to offset their United state tax obligation by the amount they have actually already paid in tax obligations abroad," states Lewis.

Not known Facts About Feie Calculator

Below are a few of the most often asked inquiries about the FEIE and other exemptions The Foreign Earned Earnings Exemption (FEIE) permits united state taxpayers to exclude approximately $130,000 of foreign-earned earnings from government income tax, minimizing their U.S. tax obligation responsibility. To receive FEIE, you must meet either the Physical Visibility Test (330 days abroad) or the Bona Fide Residence Test (prove your main home in a foreign nation for a whole tax obligation year).

The Physical Visibility Test needs you to be outside the U.S. for 330 days within a 12-month period. The Physical Presence Test likewise requires U.S. taxpayers to have both a foreign earnings and an international tax home. A tax obligation home is defined as your prime location for service or employment, despite your household's home.

The Ultimate Guide To Feie Calculator

An earnings tax obligation treaty between the united state and one more nation can assist avoid double tax. While the Foreign Earned Income Exclusion lowers gross income, a treaty may give additional advantages for eligible taxpayers abroad. FBAR (Foreign Savings Account Report) is a called for declaring for U.S. residents with over $10,000 in international monetary accounts.

Eligibility for FEIE relies on meeting details residency or physical presence tests. is a tax obligation consultant on the Harness system and the founder of Chessis Tax obligation. He belongs to the National Association of Enrolled Representatives, the Texas Society of Enrolled Agents, and the Texas Culture of CPAs. He brings over a decade of experience helping Huge 4 companies, advising expatriates and high-net-worth individuals.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax obligation consultant on the Harness platform and the founder of The Tax Dude. He has more than thirty years of experience and currently specializes in CFO services, equity compensation, copyright taxation, marijuana tax and divorce relevant tax/financial planning issues. He is an expat based in Mexico - https://justpaste.it/2891m.

The foreign gained income exemptions, sometimes referred to as the Sec. 911 exclusions, leave out tax obligation on wages made Read Full Report from working abroad.

Not known Facts About Feie Calculator

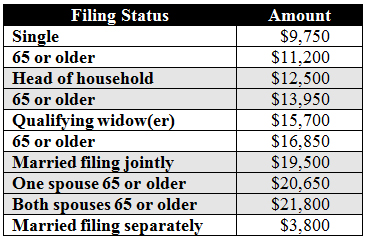

The earnings exemption is now indexed for rising cost of living. The optimal yearly income exclusion is $130,000 for 2025. The tax advantage leaves out the income from tax at bottom tax prices. Formerly, the exclusions "came off the top" minimizing revenue based on tax obligation on top tax rates. The exclusions might or may not lower earnings utilized for other objectives, such as IRA limitations, kid debts, individual exemptions, etc.

These exclusions do not excuse the earnings from US tax however just supply a tax obligation reduction. Note that a single individual functioning abroad for all of 2025 who gained concerning $145,000 without any other income will have gross income minimized to no - successfully the same answer as being "free of tax." The exemptions are computed daily.